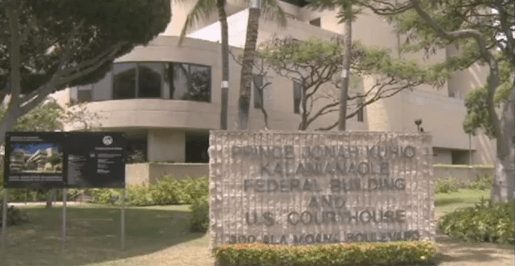

Estrellita “Esther” Garo Miguel, age 62, a Honolulu mortgage broker who operated the business “Easy Mortgage,” was sentenced January 7, 2013, to 52 months imprisonment by Chief United States District Judge Susan Oki Mollway for her operation of a mortgage fraud and money laundering scheme. Miguel had pled guilty to conspiracy to commit wire and mortgage fraud, substantive counts of wire fraud and mortgage fraud, and money laundering.

An order requiring Miguel to pay restitution was held in abeyance by the Court pending receipt of additional information from victim lending institutions in the case. To date, 21 other charged defendants have pled guilty to charges arising out of the investigation into the activities of Miguel and loan officers working for Miguel at Easy Mortgage.

United States Attorney Florence T. Nakakuni said that, according to information produced in court, Miguel, owner and operator of the mortgage business “Easy Mortgage,” hired and trained multiple loan officers, who, along with Miguel, regularly submitted loan applications to lenders with false employment, income and residential occupancy information in order to induce lenders to fund loans for residential purchase. Miguel and other charged defendants working for Easy Mortgage also sought to deceive lender underwriters by providing false documentation concerning a borrower’s history of employment, payment of rents and bank account deposit information.

Information proffered to the court at yesterday’s hearing reflected that during the existence of the five year conspiracy to defraud mortgage lending institutions over 200 fraudulent loans were obtained involving over 100 properties. Miguel and her coconspirators utilized a number of methods to fool lender underwriters into authorizing loans, including false employment and income information, fake Verification of Rent and Deposit forms, along with bank statements which had been cut and pasted to appear as if they were actual bank statements reflecting bank deposits of loan applicants. Some fraudulently obtained loan proceeds were funneled into a bank account controlled by Miguel and later distributed to her and others, which formed the basis for Miguel’s money laundering conviction.

The case was investigated by the Federal Bureau of Investigation and the Internal Revenue Service – Criminal Investigation, and was prosecuted by Assistant U.S. Attorney Ken Sorenson.

Submitted by the US Attorney’s office

There are several ways to estimate the mortgage frequency, though Refinance Mortgage Rates<a/> and refinancing activity has been highly variable over the past seven years due to both historic lower interest rates and increased ease of refinancing.

Insurance is the only sector where number of brokers is many. Due to brokers only that sector going on market aim good percentage .Brokers we need as a medium to get something. But before going for a broker you should verify all the information about the person and also about the agency. Brokers are really helping the people but some are also making fool the people and taking money from them. SO before going for any broker you should verify properly about the locality of the person.

Comments are closed.